What happened?

I’ve been dollar-cost averaging into US ETFs for a few years.

But with the recent tariffs and geopolitical uncertainty, I’m starting to reevaluate my exposure.

On Reddit threads like r/SingaporeFI, I’m seeing more people ask the same question: Is it time to diversify beyond US markets?

Among the areas I’m looking into is Asia.

Granted, Asian countries are among those affected by US tariffs. But beyond the uncertain near-term outlook, the long-term fundamentals in many parts of Asia still seem attractive to me.

That’s why the recent launch of the Amova MSCI AC Asia ex Japan ex China Index ETF by Nikko Asset Management on Singapore Exchange (SGX) caught my eye.

I decided to take a closer look at this ETF and whether it might be one way to rebalance, diversify, and stay invested in Asia’s long-term potential.

Launched by Nikko Asset Management, the fund tracks the MSCI AC Asia ex Japan ex China Index, which captures large- and mid-cap companies in both developed and emerging markets in Asia, excluding Japan and China [1] .

It is the first ETF on SGX to track this index, offering investors a unique opportunity to tap into Asian markets with a more focused and flexible approach.

The ETF automatically reinvests dividends, which means that I can compound my investments over time.

#1 – Exposure to the region’s high-growth leaders

If you’re looking to diversify into Asian markets easily, this ETF gives investors access to major economies in Asia.

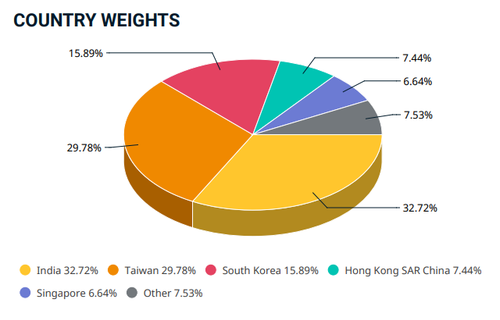

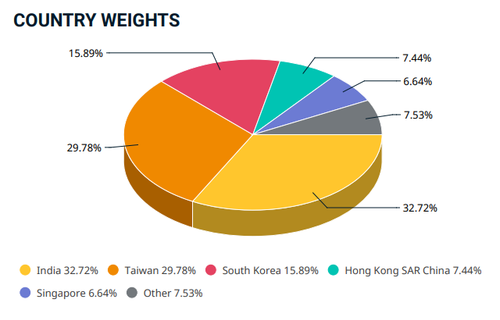

As of 31 March 2025, the top 3 holdings of the index are India (32.72%), Taiwan (29.78%), and South Korea (15.89%).

Source: MSCI, as of 31 March 2025

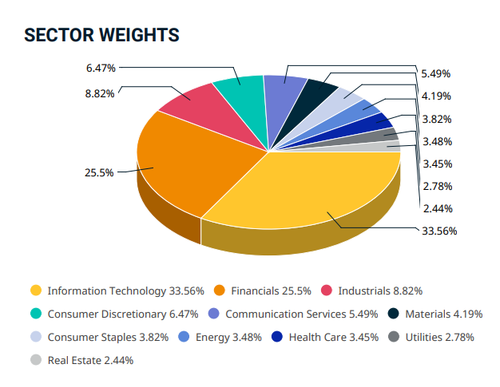

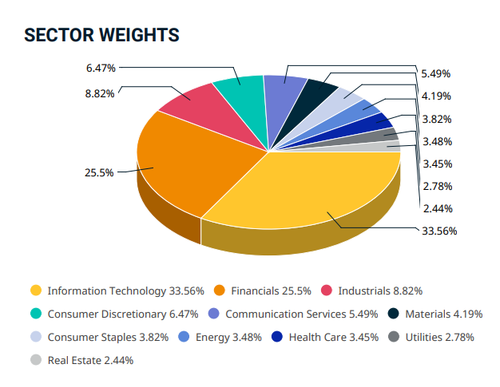

In terms of sectors, the index comprises Information Technology (33.56%), Financials (25.5%), and Industrials (8.82%) as of 31 March 2025.

Source: MSCI, as of 31 March 2025

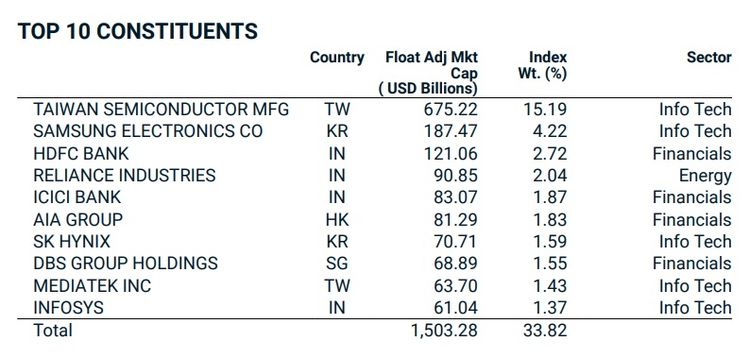

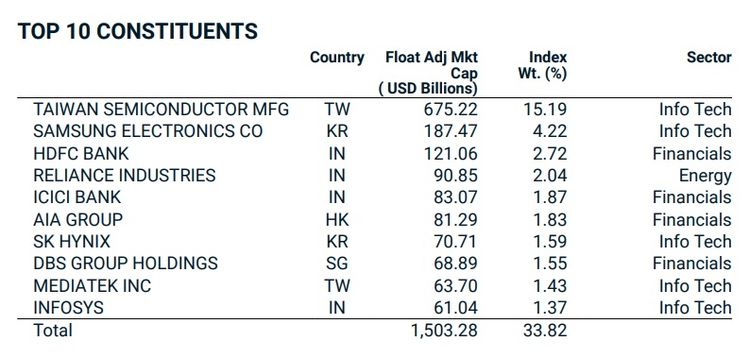

Key holdings in the index include Taiwan Semiconductor Manufacturing Co. (TSMC) at 15.19%, Samsung Electronics at 4.22%, HDFC Bank at 2.72%, Reliance Industries at 2.04%, and ICICI Bank at 1.87%.

Source: MSCI, as of 31 March 2025

This reflects a strong tilt toward innovation, technology megatrends, and rising consumption across Asia.

#2 – A more targeted approach to Asia

What caught my eye was that the Amova MSCI AC Asia ex Japan ex China Index ETF deliberately excludes China and Japan.

These are Asia’s two largest economies, and they often dominate traditional regional funds.

This is because their sheer size can skew the allocation of many Asia-focused ETFs, leaving investors overexposed to them and underexposed to the rest of the region.

By removing them from the equation, this ETF allows investors to take a targeted exposure to Asia, giving weight to markets like India, Taiwan, and South Korea, and ASEAN countries.

With this ETF, I can allocate more deliberately within Asia, reducing unintended concentration risk.

And I can still choose to gain exposure to China and Japan through separate funds if desired.

#3 – Designed for accessibility and efficiency

One of the key reasons I’ve always gravitated toward ETFs is their simplicity.

The Amova MSCI AC Asia ex Japan ex China Index ETF makes it easy for retail investors like me to get broad exposure to multiple Asian markets in a single trade, without the usual complications of investing overseas.

I don’t have to research and buy individual stocks across multiple countries, or deal with the regulatory nuances and currency conversions for markets like India or South Korea.

This ETF gives me instant diversification with a low total expense ratio, capped at 0.60% per annum (Source: Nikko AM, Mar 25), and it is listed on the SGX.

Like all ETFs, it trades just like a regular stock, which means it offers real-time pricing, liquidity, and full transparency. You can buy or sell it during SGX market hours.

This ETF tracks the MSCI AC Asia ex Japan ex China Index.

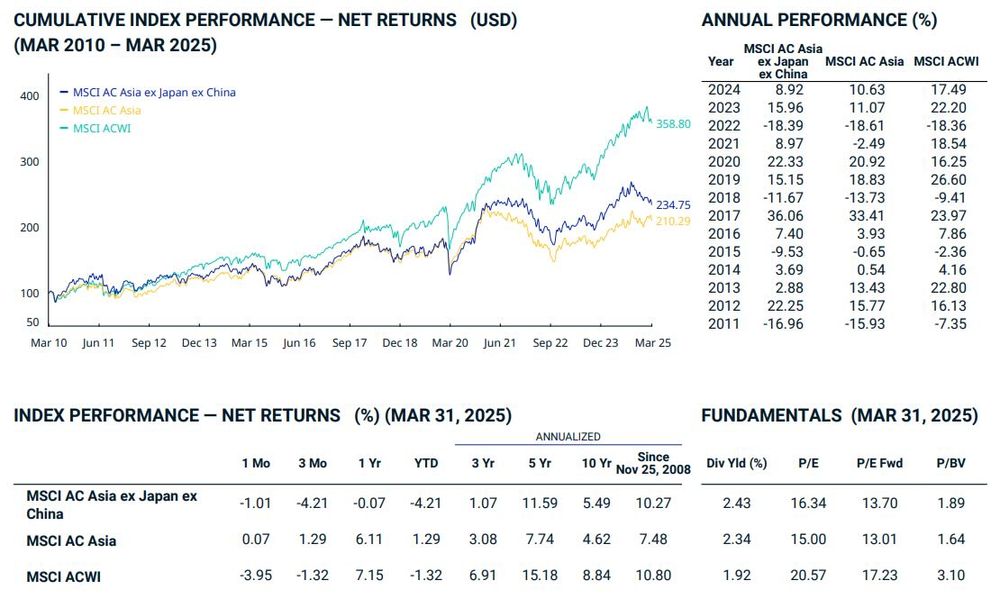

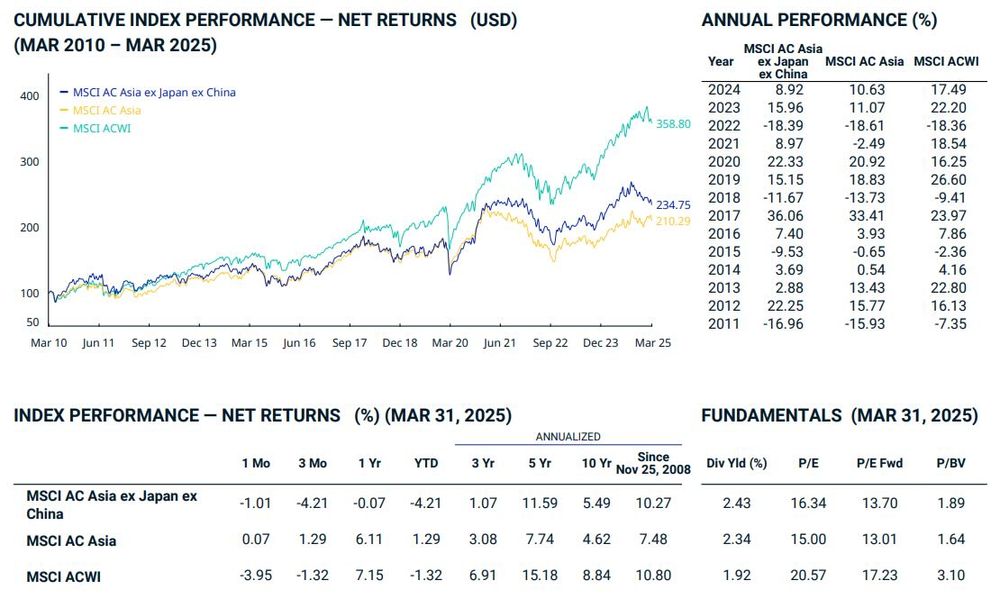

While past performance is not indicative of future results, as of 31 March 2025, the index delivered annualised 3-year return of 1.07% p.a, 5-year return of 11.59% p.a, 10-year return of 5.49% p.a, and since inception in 2008 of 10.27% p.a.

Source: MSCI, as of 31 March 2025

Performance of the index is not exactly the same as that of the ETF. Index performance does not factor in any fund expenses of an ETF. Past performance is not indicative of future performance.

AC = All Country | ACWI = All Country World Index | Div Yld = Dividend Yield | P/E = Price-to-Earnings | FWD = Forward | P/BV = Price-to-book value

The Amova MSCI AC Asia ex Japan ex China Index ETF is listed on the Singapore Exchange (SGX) and can be traded under two different stock codes:

- A93: Traded in Singapore Dollars (SGD)

- A94: Traded in US Dollars (USD)

This dual-currency listing offers investors the flexibility to choose their preferred trading currency.

The ETF is structured with a minimum board lot size of 1 share. This makes the ETF accessible to beginner investors or retail investors who intend to invest in it with smaller amounts.

To invest in this ETF, you can place orders through your brokerage account, just as you would with any other stock listed on the SGX.

The ETF trades during standard SGX market hours.

What is the management fee of the ETF?

The management fee of the Amova MSCI AC Asia ex Japan ex China Index ETF is 0.50% per annum.

The total expense ratio (which already includes the management fee) is capped at 0.60% per annum, which means, any expenses beyond 0.60% per annum will be absorbed by the fund manager and not end investors like you and me.

Source: Nikko AM, Mar 25

What are the risks and considerations?

Investing in the Amova MSCI AC Asia ex Japan ex China Index ETF offers exposure to dynamic Asian markets, but it's essential to be aware of certain risks:

#1 – Global economic uncertainty

Asian markets, both developed and emerging, tend to be exposed to global economic fluctuations.

Recent escalations in trade tensions, such as the U.S. imposing significant tariffs on various countries, have led to heightened market volatility.

So it’s important to assess your risk appetite and whether diversifying into Asian markets aligns with your financial goals and comfort level.

#2 – Currency risk

While the ETF is listed on the SGX in both SGD (A93) and USD (A94), the underlying assets are denominated in various local currencies.

This exposes investors to currency risk, as fluctuations in exchange rates can affect the value of the ETF.

For example, if the Indian Rupee or South Korean Won depreciates against your chosen trading currency, the returns from those markets may be diminished when converted back to SGD or USD.

Additionally, some Asian currencies may experience higher volatility.

What would Beansprout do?

The Amova MSCI AC Asia ex Japan ex China Index ETF offers exposure to Asia in a targeted and controlled way.

By focusing on high-growth markets like India, Taiwan, and South Korea, while deliberately excluding the heavyweight economies of China and Japan, the ETF provides more balanced exposure to regions with robust economic prospects.

However, it's essential to remain mindful of inherent risks, including current global economic uncertainties and currency fluctuations.

Learn more about the Amova MSCI AC Asia ex Japan ex China Index ETF here .