Three scenarios: transitory volatility, US recession with and without stagflation

Because our scenarios draw from various potential outcomes of the escalating US trade barriers, we also translate each scenario into terms of possible trade détente (de-escalation). The three scenarios the GIC has reviewed are as follows:

Scenario 1: “Close call” market volatility followed by trade détente

Scenario 1 involves a three-standard-deviation move in equity volatility, followed by either immediate or phased stabilisation (transitory impact), with knock-on effects on US growth and inflation. The scenario only focuses on market volatility and its impact, which is resolved before the end of the year. The volatility will have some impact on growth and inflation but the effect will be temporary as the assumption of this scenario is trade détente. In this scenario, it is possible to narrowly avoid a US recession.

Scenario 2: US recession with disinflation

Scenario 2 assumes that growth pressures on the US economy counterbalance the inflationary impact of tariffs. Even though tariffs may add 1% to core PCE, the slump in domestic demand (-1.7% to -3.9%) would outweigh this effect. The scenario assumes some eventual scaling back of tariffs, but the partial reversal does not prevent US growth from declining due to ongoing uncertainty and damage to corporate investment and hiring. We also consider the impact of other policies such as “DOGE” dismissals of government and agency employees, deportations and the accompanying chilling effect on consumption and employment among workers. In this scenario, the drop in demand offsets any inflationary impact from tariffs. Furthermore, the Fed could deliver a series of interest rate cuts before the end of the year to allay the pressure resulting from the decline in demand.

Scenario 3: US recession with stagflation

In Scenario 3, the slump in demand does not outweigh the inflationary impact of tariffs, leading to persistent inflation expectations (adding a persistent 2.6%). The damage to real growth stems from both soft demand and erosion of consumer purchasing power. The GIC sees this scenario as consistent with an escalation to an all-out trade war, where the US consumer bears the cost of tariffs and retaliatory measures. The Federal Reserve (Fed) is unable to offer much additional stimulus because of its price stability mandate. This is the most pessimistic of the three scenarios and could be negative for risk assets. However, it could also present opportunities for selective investment in companies capable of increasing productivity in a higher-cost environment.

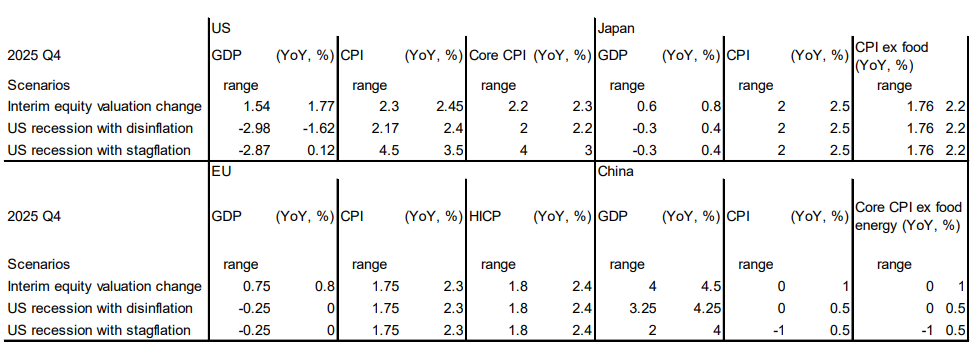

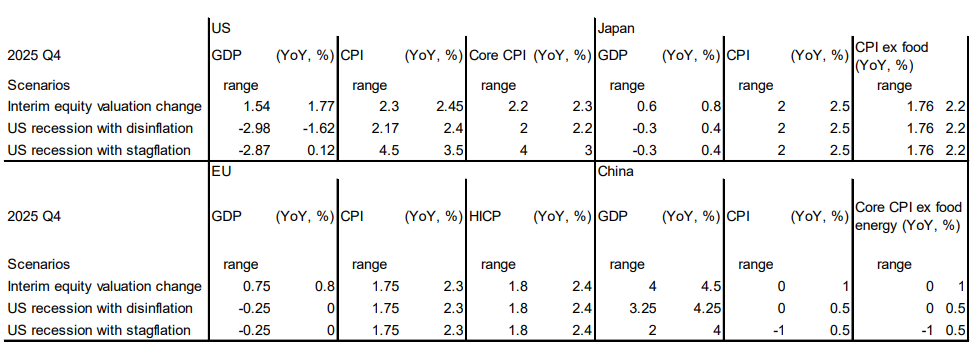

Global macro: disperse impact of US growth and inflation scenarios

We performed some basic simulations of shocks to US domestic demand and inflation expectations to estimate the impact on US growth and inflation. We referenced IMF estimates on the impact of tariffs and trade uncertainty on other regional economies to produce assumptions of annual growth at the year-end for the US, Japan, the EU and China.

US scenarios:

Scenario 1 involves a close shave with near-zero growth in mid-2025, yet with the US still posting positive growth (between 1.54% and 1.77% in 2025) along with contained inflation. Core CPI is projected to be between 2.2-2.3%.

Scenario 2 involves a prolonged recession that involves year-on-year growth rates of between -2.98% to -1.62% as of Q4 2025. Core CPI is expected to ease modestly to 2-2.2%, which allows the Fed to cut rates.

Scenario 3 involves much greater uncertainty, with a dip into negative growth but real growth rates somewhere between -2.87% and 0.12% year-on-year as of Q4 2025, with core CPI estimated to be between 3% and 4%.

Japan scenarios:

Scenario 1 is the most positive scenario for Japan. Growth remains above potential (0.6%-0.8% in 2025, compared to the potential growth rate of 0.5%).

In the two recession scenarios (Scenarios 2 and 3), growth is estimated to fluctuate between positive and negative, resulting in GDP growth ranging from -0.3% to 0.4% in 2025. We continue to see CPI ex-food as likely to remain positive in all scenarios (between 1.76% and 2.2%). This is due to our assumption that, even if tariff-spurred stagflation emerges in the US, counteracting disinflationary pressures (such as those from Chinese exports) will prevent any spillover and allow the BOJ to continue focusing on domestic inflation expectations to guide policy.

EU scenarios:

Similar to Japan, due to a stronger commitment to fiscal expenditure and controlled inflation alongside ongoing European Central Bank (ECB) easing, we assume that Scenario 1 would result in subdued but positive GDP growth for the EU in 2025, ranging from 0.75% to 0.8%.

Scenarios 2 and 3 are mild recession scenarios for the EU, with growth projections ranging from -0.25% to 0%. Similar to the Japan scenario, we expect minimal variation in core HICP across scenarios, with inflation expected to remain mild in the EU, hovering around the ECB’s target, at between 1.8% and 2.4% by year-end.

China scenarios:

Considering the assumptions about the escalating trade war between the US and China and their implications for the US scenarios, we think that the potential for variation in China’s GDP and CPI will depend on the US scenarios. In Scenario 1, assuming a trade détente, GDP growth is expected to fall short of China’s 5% target, but not by far, posting a rate of 4-4.5% in 2025.

In Scenario 2 (which assumes some roll-back of tariff measures), GDP growth is estimated to be 3.25-4.25%.

In the stagflation scenario (which assumes a full-blown trade war), GDP growth is estimated at 2-4%. Both headline and core CPI are expected to remain positive at between 0-1% in the détente scenario, and also, albeit reduced, in Scenario 2. However, in Scenario 3, deflation is most likely to persist as the full-blown trade war hits Chinese employment and household incomes, with core and headline CPI estimated between -1% and 0.5%.

In both Scenarios 2 and 3, China may double down on its fiscal stimulus measures targeted at propping up consumption. However, the maximum impact of such measures is likely to be felt with a lag after their implementation.

Why not zero growth for China in a full-blown trade war?

The last time China experienced negative growth was when both consumption and production were forcibly interrupted by the COVID-19 pandemic in 2020. In 2022, when regional COVID outbreaks, such as the one in Shanghai, hindered local production in some urban centers, growth slowed significantly but did not turn negative.

China’s economy is only 37% trade-dependent, with exports constituting around 20% of Chinese GDP, and US exports accounting for less than 20% of total exports. Therefore, it would be extremely difficult to forecast negative growth for China, even if exports to the US were to cease completely. Moreover, given the lack of substitutes for Chinese manufactured goods in the US, it is clear that the US consumer would suffer greatly if imports from China were to stop altogether.

In a full-blown trade war, the Chinese government is likely to implement additional fiscal stimulus targeted at supporting consumption, which would probably maintain positive growth. However, such stimulus measures may be felt sooner in the markets than in the real economy.

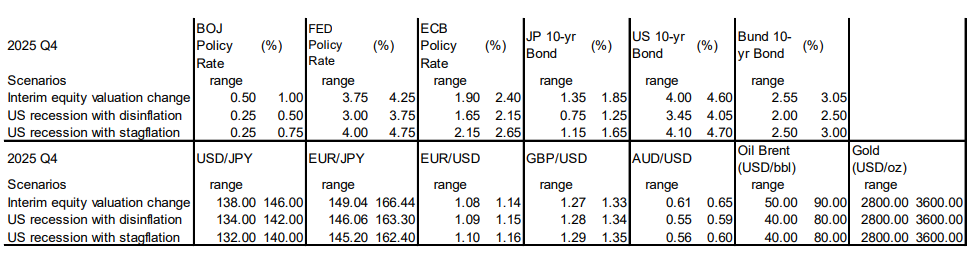

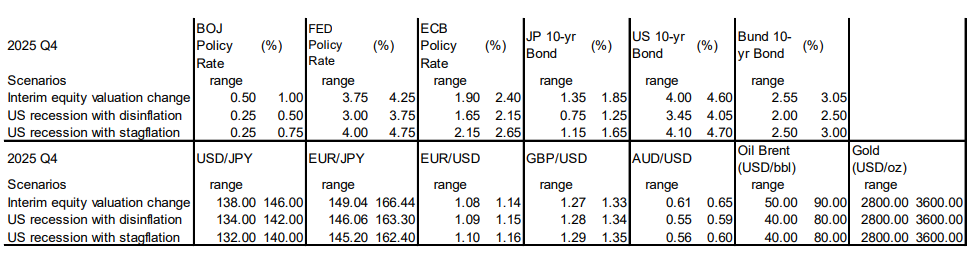

Central bank rates and forex: shades of weaker dollar, long UST, strong yen

We have identified that the US growth and inflation scenarios are also affected by Federal Reserve (Fed) policy. The first scenario assumes that interim market volatility does not influence Fed policy. In contrast, the second scenario, which involves recession with disinflation, assumes multiple Fed rate cuts. The third scenario assumes that the surge in inflation prevents the Fed from responding proactively to the blow to US growth.

Scenario 1: interim market volatility

Fed policy/US interest rates: The expected interim volatility is anticipated to have very little influence on policy rates. The Fed cannot cut much from current levels even if growth slows. The long end of the US yield curve is expected to remain stable, with estimates ranging from 4%-4.6% by the end of 2025.

BOJ policy/Japan interest rates: There is not a significant difference from the scenario outlined at the March GIC: inflation persists, as does the need for gradual removal of BOJ accommodation. Long-end rates are estimated to fluctuate but ultimately to remain stable, expected to be between 1.35% and 1.85% by the end of 2025.

Europe/Bunds: The ECB is expected to continue cutting rates, and 10-year Bund yields are estimated at between 2.55%-3.05% by the end of 2025. Further detail on fiscal expansion by Eurozone economies, particularly Germany, remains key in all scenarios, including that of détente.

FX: As elaborated in the March GIC, ongoing BOJ policy normalisation means the stronger yen is the main factor contributing to dollar weakness. Dollar/yen is expected to range between 138-146 by the end of 2025.

Oil (Brent crude): In this scenario, oil prices are anticipated to fluctuate wildly within USD 50-90/per barrel. Concerns about slower growth may initially push down oil prices, but they could rebound as recession fears are priced out. This scenario could present significant investment opportunities for infrastructure and energy sectors, both in real assets and listed investments, with opportunities to capitalise on dips.

Gold: Gold remains “a buy on dips” in all scenarios given the uncertain outlook for the dollar and US Treasuries, even in the most positive scenarios. A sustained rally in gold prices is expected, with the precious metal seen reaching USD 3,600 per ounce by the end of 2025. Gold may experience structural upside given the intensified search for replacement risk havens for US Treasuries and the dollar.

Scenario 2: US recession with disinflation

Fed policy/US interest rates: In the disinflationary recession scenario, there is significant room for rate cuts, particularly given the anticipated impact on US jobs and incomes. Even in this scenario however, the combination of uncertainty about trade policy, the stretched US fiscal position and likelihood that long-term inflation expectations may not decline much means that long-term yields would also remain elevated, keeping the term premium intact as of the end of 2025. The Fed’s policy rate is projected to be in the range of 3-3.75% by the end of 2025.

Non-US interest rates: Both the ECB and the Bank of Japan (BOJ) are likely to remain comparatively more dovish. The BOJ has hardly any room to cut rates, however, especially if inflation persists (the BOJ’s policy rate is projected at 25-50 basis points in this scenario). Long-end JGB yields may modestly decline in a slower US growth situation, ranging from 0.75-1.25%. The ECB may modestly prolong its rate cut cycle in this scenario, ending 2025 with the policy rate between 1.65 and 2.15%; the 10-year Bund yield is forecast at between 2.25-2.50%.

FX: Thanks in part to the Fed’s rate cuts, the dollar is likely to weaken significantly against a broader range of currencies (yen, euro, pound). However, the Australian dollar is also expected to weaken as Chinese demand and overall risk assets remain soft.

Oil (Brent crude): In the two recession scenarios, oil is likely to fluctuate in a slightly lower band, between USD 40 and USD 80 per barrel, with the average somewhere around USD 60. This presents opportunities to buy on the dips, particularly for those looking for beneficiaries in the energy and infrastructure areas.

Scenario 3: US recession with stagflation

Fed policy/US interest rates: The Fed cannot cut rates, but if the US faces endemic issues such as those arising from tariffs, a shortage of government services and limited imported labour, the recession may be worse for the US than for the rest of the world. This is particularly true given disinflationary pressures, including declining energy prices and increased competition for manufactured goods prices as China doubles down on non-US exports. The US yield curve is expected to steepen further as a result, leading to an increase in the term premium.

Non-US interest rates: In the event of endemic US inflation, the ECB is expected to significantly cut rates, but the BOJ will have limited room to move, similar to Scenario 2. But if Japanese inflation does not accelerate, the BOJ could cut rates due to poor growth. At the same time, the rise in long-term US yields may exert upward pressure on both the 10-year JGB yield (1.15-1.65% in this scenario as of the end of 2025) and the 10-year Bund yield (2.5-3% in the stagflation scenario as of the end of 2025).

Oil (Brent crude): In this scenario tariffs are the most extreme, and cracks are expected to begin appearing in US Treasuries’ (USTs) status as a safe-haven asset. The erosion of USTs’ safe-haven status may intensify and the cost of new financing could gradually increase, potentially impacting new exploration projects in the energy industry.

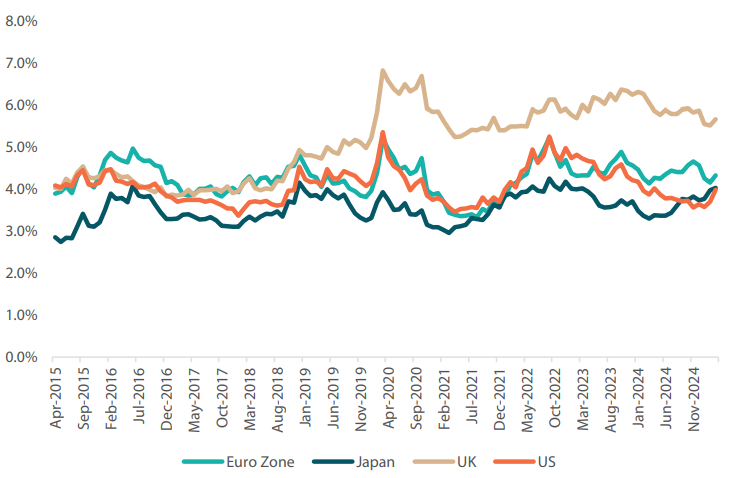

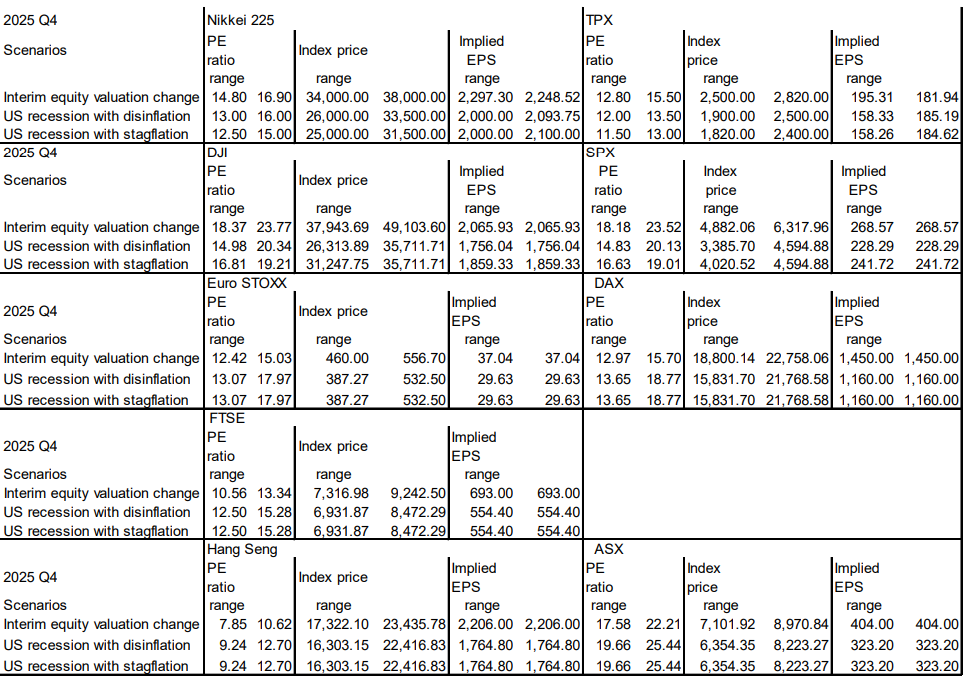

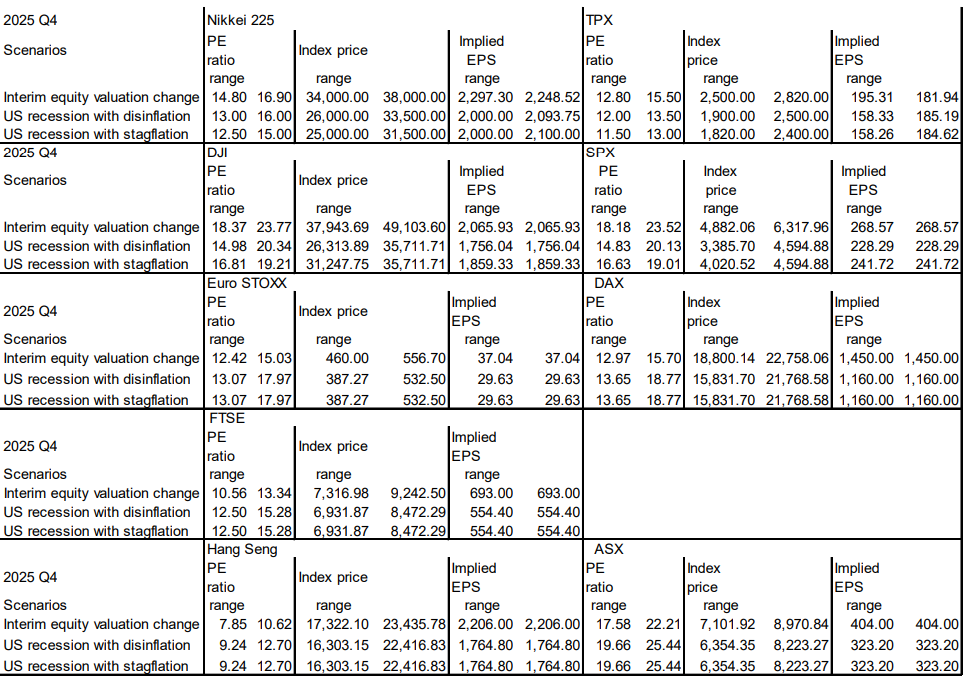

Equities: recession scenarios clearly more negative

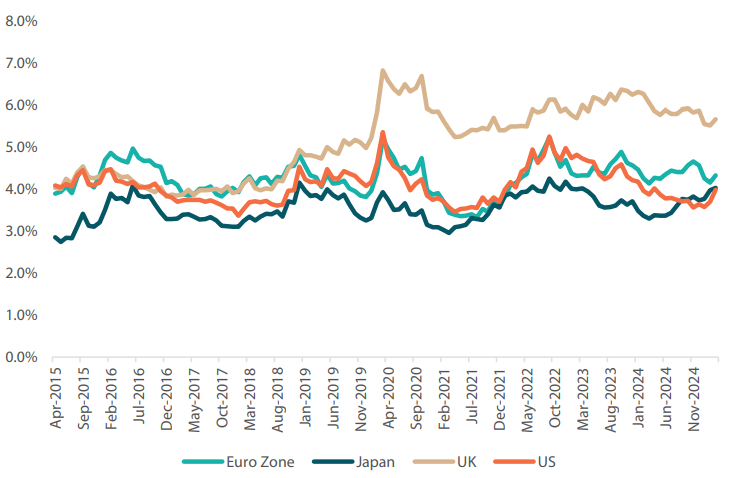

Despite the recent rebound in US equity risk premiums and the correction in US valuations, it is worth noting that other equity markets offer more generous compensation to investors for risk taken (see Chart 1). This suggests there may be further corrections in negative growth scenarios for the US.

Chart 1: Comparison of equity risk premiums

Source: Nikko AM

Scenario 1: interim market volatility

US stocks (S&P 500): In this scenario, the GIC assumes that US calendar year earnings will decrease by 5% from current expectations on tariff dislocations. The median case projects a forward price-earnings ratio of 20.5 due to the more uncertain environment.

Japan stocks (TOPIX): EPS growth is expected to slow from the recent 10.5% growth to around 5.2% due to uncertainty, interim volatility, the slowdown in US growth and the strengthening of the yen.

In this scenario there could be some negotiation on tariffs, but not a return to zero tariffs. Instead, tariffs could revert back to a base level of 10%, which could still weigh on growth. EPS growth could remain under pressure for this reason. Moreover, a stronger yen may also weigh on EPS growth.

If the market is already pricing in a slower economy, it may be difficult for the BOJ to steadily hike rates, especially if there is yen appreciation. The market appears to be expecting the yen to strengthen, particularly as talks between the US and Japan progress. There is belief that the US may prefer a weaker dollar against the yen, and a weaker dollar/yen could exert pressure on the EPS of Japanese exporters. As a rule of thumb, a one-point move in dollar/yen is estimated to have an impact of -0.3% to -0.4% on Japanese exporters’ EPS.

Global Equities: Valuations may remain under pressure in Europe as the initial rally based on expectations of a swift end to the Russia-Ukraine conflict have not materialised. In the interim volatility scenario, “hot” money could actively drive equity valuation. Despite potential increases in European defence spending in the long term, speculators may withdraw from Europe if the Russia-Ukraine conflict continues.

China remains a particular target of the US administration’s trade policy, which may keep Hong Kong’s Hang Seng under pressure, assuming all other factors remain equal. US-China negotiations could be drawn out even in this scenario, as Chinese retaliation to US measures could prolong the resolution process.

Australia’s ASX is expected to struggle as commodities remain under pressure due to weak Chinese demand, compounded by the ongoing US-China trade uncertainty. In scenario 1, most of the pressure is likely to be on valuations. However, in scenarios 2 and 3, earnings are expected to suffer as US growth slows with scenario 3 indicating an escalation in the trade war.

Scenario 2: US recession with disinflation

US stocks (S&P 500): This scenario assumes calendar year 2025 earnings will be 15% lower than current expectations, with a possibility of a further 20% decline in calendar year 2026 earnings. This would put the median valuation multiple at 17, with Fed rate cuts supporting sentiment.

Japan stocks: Returning to the scenario of “reciprocal” tariffs announced on 2 April and additional product-specific tariffs, for Japan the most extreme measures were 25% “reciprocal” tariffs along with 24% tariffs on autos and steel. These would be unquestionably bad for Japanese exports. However, the US could roll back some of these tariffs if growth slows. The Fed’s ability to cut rates and buoy risk assets in the US may spill over into Japanese markets, limiting the decline compared to than in the stagflation scenario.

Moreover, disinflation expectations in the US, which could weigh on the dollar/yen, may exert pressure on the earnings of large Japanese exporters whose stocks are significant components of the Nikkei index.

Global Equities: The recession scenarios are likely to be negative for stocks as a whole. As such, the FTSE, Hang Seng and Eurostoxx valuations are expected to fall in the case of US recession. If the US experiences stagflation or disinflation, these markets may not come under as much pressure as that in the US, given that US valuations are already relatively high to begin with.

Scenario 3: US recession with stagflation

US stocks (S&P 500): In this scenario, calendar year 2025 earnings are expected to be 10% lower than current estimates, with a potential further 5% decline in calendar year 2026 earnings. This would put the median forward multiple at 15, with few policy options to alleviate the pressure. The greater estimated hit to valuation than to earnings is due to the potential for firms to take market share from tariff-beset competitors under a trade war scenario, even though the consumer may still reduce overall consumption.

Japan stocks: The recession with stagflation scenario would likely be negative for Japanese indices, influenced by factors such as tariffs and a risk-off environment which would weigh on the dollar/yen even in the absence of rapid Fed cuts. Another strong negative factor is a potential escalation of the US-China trade war and the re-imposition of stringent tariffs on US trade partners.

Global equities: The recession will be undeniably negative, but stagflation may be endemic to the US (caused by tariffs, shortage of government services and imported labour) so it may be worse for the US than for the rest of the world. Outside of the US, there are offsetting sources of disinflationary pressures. These include the potential for declining global energy prices and increased competition for manufactured goods prices, especially with China doubling down on non-US exports. Therefore, the valuation and earnings dynamics outside the US are expected to be different than in the US. US demand is certainly important and can weigh on non-US earnings. However, the erosion of margins is not a foregone conclusion outside the US where valuations are historically much lower.

On the upside, China could step in at any time to offer stimulus, which could benefit nations not exposed to severe retaliatory trade tariffs. China is more likely to focus on boosting consumption if the impact of the trade war turns out to be severe.

GIC verdict: recession may be avoided, yet risks of slower growth loom large

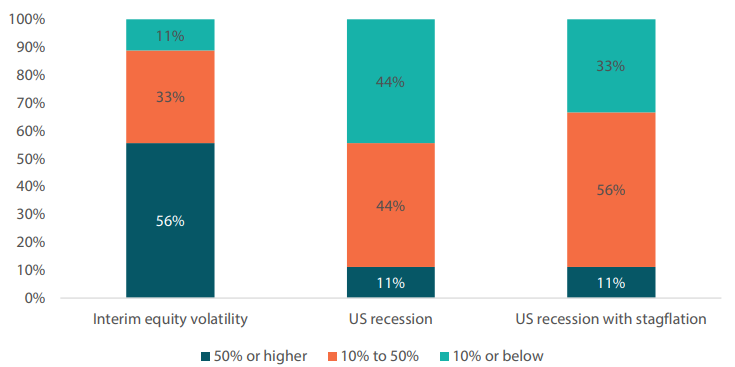

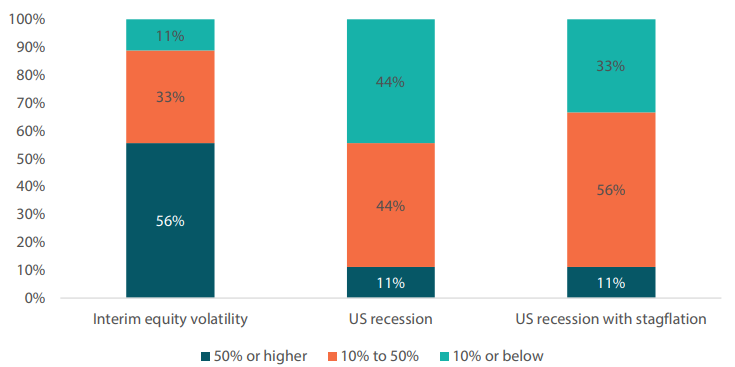

After reviewing the potential implications of the three scenarios outlined above on economies and markets, GIC voters ranked the scenarios based on subjective probability, offering an aggregate firm-level perspective. The majority of voters (56%) assigned a 50% or higher probability to Scenario 1, which involves interim volatility associated with tariff announcements, followed by détente and some degree of market normalisation.

At the GIC meeting, some voters opined that there was more potential for positive outcomes than the market was pricing in at the time, especially considering the substantial jump in US equity risk premium. At the time of the GIC meeting, the market may have been underestimating the possibility of a positive shift in US trade policy, as the negative market reaction itself could signal a need for policy adjustments and lead to a reduction in uncertainty over time.

That said, voters often found it difficult to rank the likelihood of scenarios. Many had strong views of either the likeliest or least likely of scenarios and were indifferent between the two remaining scenarios. As a result, although 56% of voters assigned a 10%-50% likelihood of the recession-stagflation scenario (Scenario 3), voters were divided on its likelihood compared to other scenarios. Consequently Scenario 3 was deemed modestly less likely than Scenario 2 (recession with disinflation).

For example, one voter, who selected both recession scenarios over the temporary volatility scenario, expressed scepticism towards a negotiated détente, but viewed the likelihood of the two recession scenarios similarly. The voter pointed out that price uncertainty could stem not only from policy-related issues but also from discrepancies in inflation rates between the US and other regions, notably China. The world’s second largest economy has been mired in deflation; as the target of US trade tensions, it could double down on price-competitive exports to other countries, particularly if Washington fails to economically isolate it.

Chart 2: Distribution of GIC votes per scenario

Source: Nikko AM

Although the GIC’s central view is that the US is unlikely to succeed in isolating China, voters expressed disperse views over the ultimate outcome of the escalating trade war. One voter expressed the view that the disinflation-recession scenario (Scenario 2) was the most probable, expecting the US to broker deals swiftly with nations other than China.

Another voter held the view that even if a détente was achieved, China might have incentives to prolong negotiations, leveraging its ability to impact US consumers and voters by maintaining tariffs at a high level. Additionally, it was perceived that China could wield its economic might to influence other trade partners. As one reference point, China’s share of GDP, if expressed in PPP terms, now surpasses that of the US (see Chart 3 below).

Chart 3: China’s share of GDP in PPP terms

Source: World Economic Outlook (October 2024) - GDP based on PPP, share of world

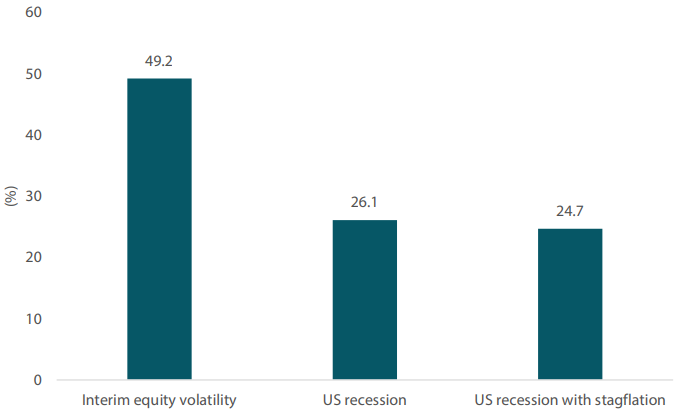

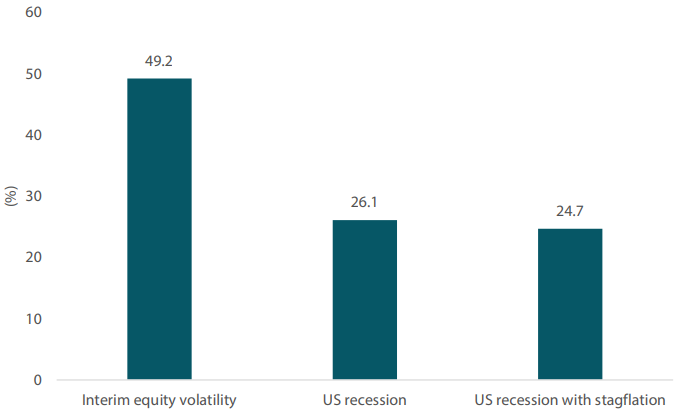

After factoring in the uncertainty expressed by voters in their rankings, the GIC determined that Scenario 1—the interim equity volatility scenario—carried the highest probability. Though the probability assigned to Scenario 1 substantially surpassed those assigned to Scenarios 2 and 3, it remains modestly below 50%. This illustrates that uncertainty remains high, as even the lower probabilities assigned to the recession scenarios are nowhere close to zero. As of 10 April, on aggregate, the GIC assigned probability of above 25% to the disinflation-recession scenario, closely followed by the stagflation-recession scenario at slightly below 25%.

We conclude by reiterating that the scenario probabilities presented by the GIC as of 10 April are subject to change depending on how circumstances unfold. As the US responds to market developments and engages in trade negotiations with other countries, we (and other market participants) will update our prior assumptions. After observing the actions of the US and its trade partners over several rounds of negotiations, uncertainty could subside. For now, a recession, the accompanying risk-aversion, risks to growth and inflation expectations all remain active possibilities. Our recommendation is to pursue portfolio diversification strategies accordingly to better navigate the ongoing uncertainties.

Chart 4: GIC’s aggregate scenario probabilities

Source: Nikko AM